Corporate restructurings in India present complex legal challenges and one key factor often is the stamp duty payable on court-sanctioned mergers, a popular method used for such restructurings. The uncertainty stems from different local stamp duty laws across states and notifications (some dating back to the pre-independence era) which cap the stamp duty amount payable or even exempt certain type of transactions.

A recent decision of the Delhi High Court in the case of Ambuja Cement Ltd. vs. Collector of Stamps, provides some much-needed clarity on stamp duty payable on a merger between two subsidiaries of a common parent pursuant to a court-sanctioned amalgamation scheme. The High Court extensively scrutinized the applicability of stamp duty on a scheme of amalgamation under the Indian Stamp Act, 1899, as well as the enforceability of a notification issued in 1937 exempting payment of stamp duty for intra group mergers in Delhi. This article examines the key issues, arguments, and implications of this landmark ruling.

Background

Key findings

Nature of merger order – whether conveyance?

Enforceability of 1937 Notification – still applicable?

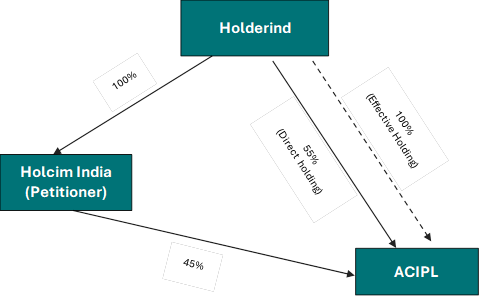

It was contended that the merger between Holcim India and ACIPL, both subsidiaries of a common parent company (i.e., Holderind)satisfies the third condition and accordingly no stamp duty is payable even if the merger qualified as a conveyance under the Act.

Analysis

Authors: Neville Golwalla – Partner; Gayatri Chadha – Managing Associate and Aanchal Kabra – Associate

Footnotes:

[1] (2009) SCC OnLine Del 3959

[2] (2004) 9 SCC 438

Disclaimer: This alert only highlights key issues and is not intended to be comprehensive. The contents of this alert do not constitute any opinion or determination on, or certification in respect of, the application of Indian law by Talwar Thakore & Associates (“TT&A”). No part of this alert should be considered an advertisement or solicitation of TT&A’s professional services. This communication is confidential and may be privileged or otherwise protected by work product immunity.

By browsing this website you agree that you are, of your own accord, seeking further information regarding TT&A. No part of this website should be construed as an advertisement of or solicitation for our professional services. No information provided on this shall be construed as legal advice.

Agree Disagree